One thing I have run into with many clients is that the incentives for their sales teams are not always completely aligned with the company’s interests. You would think that having a commissioned sales force should be enough, but it gets more nuanced than that. We’ll discuss these intricacies below. By the way, this has absolutely nothing to do with the scandal at Wells Fargo, and will not touch on it.

The most generic type of commission plan is one that compensates a salesperson a certain percentage of sales for each sale that is made. The advantage of these plans is that they are simple for everyone to track and are pretty unambiguous (not subject to many accounting gimmicks). You have someone that makes more money as they generate additional sales for the company, which should be a good thing. So, what could be the problem? As we have discussed, not all sales are equal, and not all sales translate to profitability.

First, let me say that a straight commission on sales is most likely fine if the company retains control over pricing, customers are well established, and there are typically no issues with collections.

If the nature of your business is such that there is a some room for negotiation on pricing and there is a lot of customer churn (who are billed on account), it could be worthwhile to contemplate a change to your compensation system.

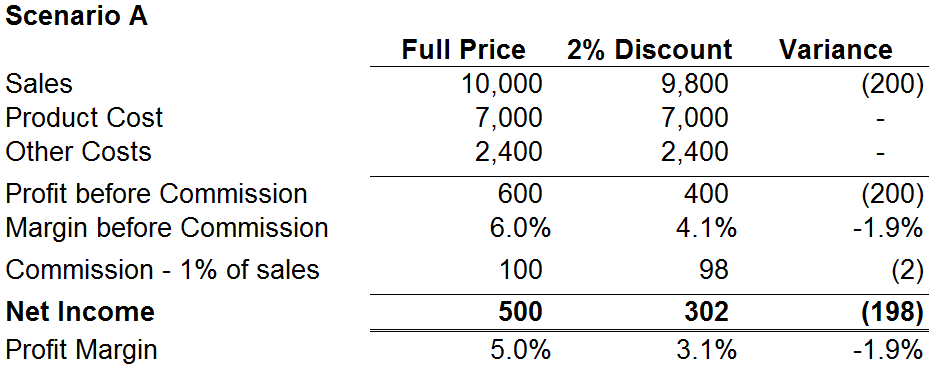

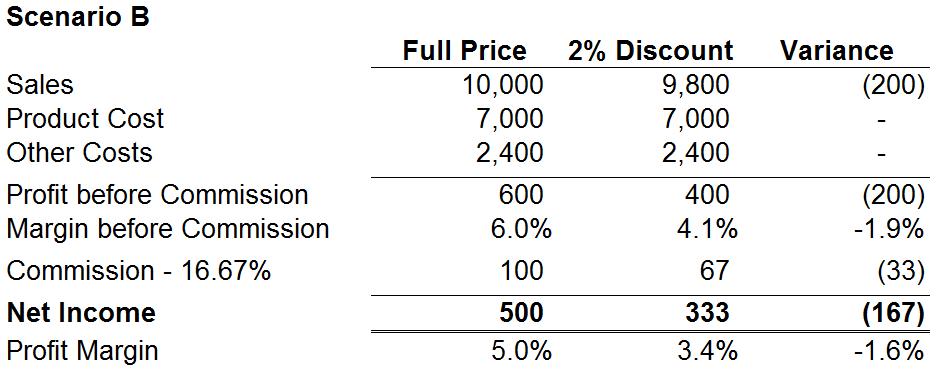

Below is an example that illustrates where incentives are not directly aligned (for simplicity sake, I eliminated taxes).

In Scenario A, the salesperson earns a 1% commission on sales. Let’s assume the company’s average profit margin is 5% overall (not spectacular, but decent). So, for a $10,000 sale, the company should net $500, or 5%. In this example, the sales force has some room to negotiate on price, for a 2% reduction in price, the company now earns only $300, or 3%, while the salesperson only loses $2 on their commission, from $100 to $98. They might tell you that the customer needs that pricing, but perhaps they initiate the conversation in order to close a quick sale. How would you ever know, most likely, you won’t.

In Scenario B, we tie the commission to amount of money the company earns on the sale (after allocating other costs). Using the same example as before, the profitability before commissions is $600, so the required rate to earn the same $100 commission (at normal pricing) would be 16.67% (100 / 600). Now, if the pricing is reduced 2%, which by the way, reduces the company’s profitability before commissions by 33%, the commission ends up going down by the same 33%.

So, what would be the solution if I could wave my magic wand? Commissions would be tied to company profitability and would be paid after the payment is received from the customer. This type of structure ties the salesperson to be invested in the company’s profitability, and also care about collecting the funds. In times of rising input prices, they have an incentive to push for pricing adjustments. Perhaps they can also contribute to cost reduction efforts, it’s possible they learn something on the outside that can translate into the company’s operations.

The reason I have added the payment criteria is that once the salesperson has their commission check, they may not want to risk agitating a customer. They can point the finger to Accounts Receivable that it is their responsibility to collect (there is some truth to this). However, they might be more judicious when dealing with a customer that could have a poor credit rating or bad reputation.

So, should you make the switch? As with almost everything in life, it depends. Here are some questions to answer first:

- Will it be easy? Probably not, but your focus should not be on easy, it should be questioning if this can be done right. This means that all the necessary processes have to be in place on the front end and proven out. You don’t want to repeat what happened at HP.

- What are the potential pitfalls? Well, all of the obvious ones, and probably some you can’t think of. You can potentially lose the confidence / trust of your sales force, but doing it right can go a long way. Admittedly, would you necessarily welcome a change to your compensation structure if you did not initiate it?

How should you go about implementing something like this (or any change to sales compensation)? The short answer, very carefully!! Here are some other points to keep in mind:

- Engage your people in the process, emphasize you will only move forward if / when it can be performed smoothly from an operational perspective. Keep in mind that many factions may try to sabotage this if they don’t understand it or just plainly don’t want change.

- This would need to be transparent, easy to communicate and not distract your sales team from having to re-do the math on their end. There needs to be clear definitions of the profitability metric being used and understood by all how it is calculated. This also includes how often adjustments can be made, you don’t want to be viewed as moving the goalposts.

- As far as recalibrating the percentage, you need to establish a baseline level of volume and adjust the commission rate so they salesperson is not taking a pay cut.

- If you switch to paying upon receipt of payment, that could delay compensation. You may want to figure out some sort of draw system to alleviate a cash flow shortage. Again, this is another wrinkle that your accounting team needs to be able to manage (but not very difficult if designed well and implemented properly).

- While far down the list, you also need to be make sure there is a good AR function within the business, you don’t want a frustrated salesperson because of any internal issues on collecting and applying payments.

A final thing to keep in mind, is that just broaching the subject could be enough to get everyone’s attention into thinking more about the company’s interests overall instead of just how they personally benefit.