When it comes time to review financial statements, the implicit expectation is to always look at the income statement (and only the income statement). Everyone wants to know the sales and whether the company made any money (i.e. profits) for a given period. It’s not that the income statement does not provide useful information and is not critical to the management of the business, but it does not tell the full picture.

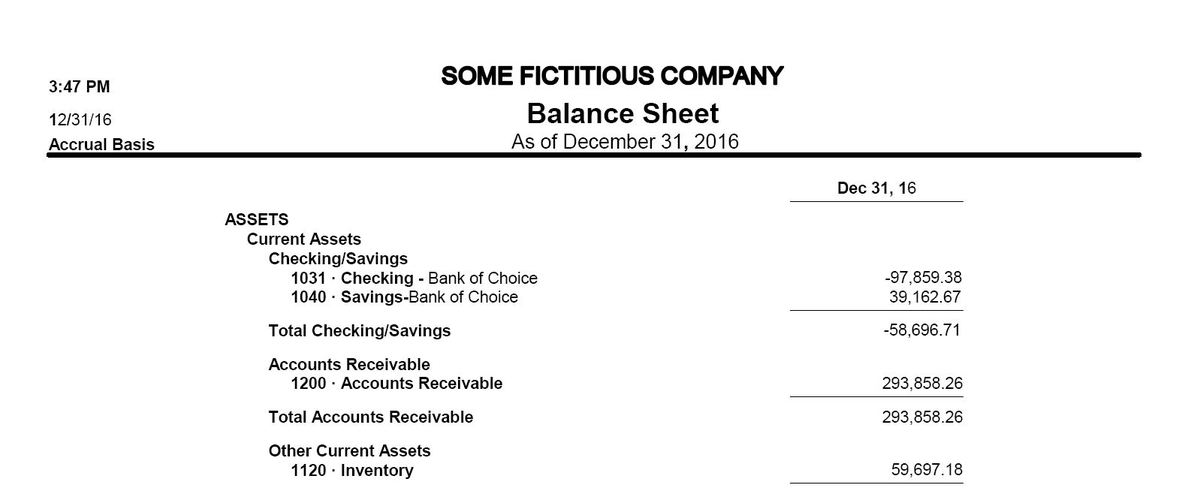

The more important financial statement in assessing a business is the balance sheet, as it truly reveals the financial health of an organization. While profits are nice, they don’t necessarily translate to cash in a timely manner (think of a customer paying in 90 days after invoice). A balance sheet can help provide clarity on the company’s liquidity and whether it will be able to continue operating, since cash is needed to pay employees, vendors and liabilities.

One other key difference with a balance sheet is it only provides a snapshot at a very specific point in time. Unless you are looking at multiple periods arranged in columns, it doesn’t necessarily provide a trend. But still, a single point in time can be extremely revealing.

With all this being said, it is best to consider both the income statement and balance sheet together, as that gives the most comprehensive view.

A Non-Finance Example

Think of an airplane flying across the ocean. The income statement can tell you the distance covered, the time elapsed in flight, the amount of fuel consumed, and the direction the plan has been flying. No doubt, this is all very important information, but there are some necessary facts lacking.

Now, consider taking a snapshot of certain items on our trans-ocean flight that are extremely vital and in some cases, could mean the difference between life and death. The top two items that come to mind are the current amount of fuel left (inventory) and the remaining miles left until a) the destination or b) the nearest point for fuel (liabilities). From an equipment perspective, the number of functioning engines could also be important. The inventory could also tell you how many dishes of fish and steak are leftover, so you can determine how many were handed out (that’s an Airplane reference for those of who didn’t catch it).

What the Balance Sheet Reveals

In its most simplistic terms, the balance sheet shows how much of the organization’s assets were funded by debt (needing near-term and / or regular payments) or equity (a more patient form of capital). The higher the ratio of liabilities to your assets means a company is in a riskier position since the liabilities are going to require cash payments in the future, which will need to be generated by earnings and / or the liquidation of assets (think of selling the furniture in order to make a mortgage payment). Equity capital is less risky since it can wait (sometimes begrudgingly) for any potential distributions.

To the extent an organization is generating profits, this only holds true so long as the balance sheet is accurate. The balance sheet is the place where losses can be hidden (sometimes gains can be stored for a rainy day, but this is less common). If a company has old inventory that is worthless, holding it at full value overstates the profits, and skews the ratio of assets to liabilities (understating the risk of credit default).

As we have recently passed the 15 year anniversary of the Enron scandal, it is important to remember this situation escalated due to the manipulation of the balance sheet. There were many very smart people fooled by shoddy financial statements. Had the auditors been doing their job correctly, liabilities would have been more accurately stated, and things likely would not have gotten as far out of hand.