Is there anyone in your firm that can tell you what the breakeven point is? If so, can they tell you how it is trending? It’s not the end of the world if you don’t know it, but it can be insightful in providing a better understanding of the business.

The breakeven point is the amount of sales that is required for the company to cover its fixed costs so it does not incur a net loss. The more fixed costs that a company has in its cost structure, the more challenging it will be for the business if sales decline. On the flip side, the company can realize stronger profits once it covers its fixed costs since the variable costs will be much lower.

To calculate the breakeven point, you need to determine which costs are variable and which ones are fixed. Keep in mind that certain expense accounts might contain both fixed and variable components. Maintenance costs could be an example where the building maintenance is fixed, but equipment maintenance will likely vary with production volumes.

Distribution Example

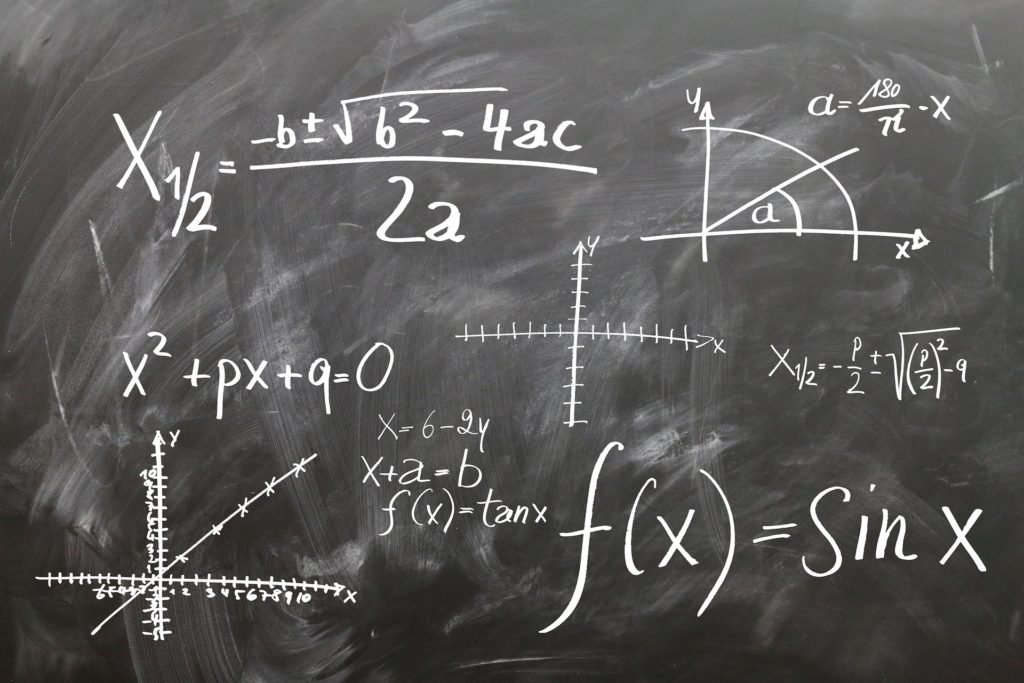

Let’s take a look at our hypothetical distributor who currently rents a warehouse and manages their own fulfillment. The company signed a lease for more space than they needed, now that the lease is up, the owner wonders if the company can do better by outsourcing the warehousing and fulfillment operations. The costs associated with storage and shipping are $215K per year (Facility costs, shipping costs and warehouse labor). Based on 40,000 annual units (avg. sale of $50), the fulfillment cost is $5.38 per unit. The company sends out an RFP to various providers and receives a bid for $5.00 per order for all fulfillment costs. In the table below, you can see how this change would impact the company’s breakeven point.

Under the baseline configuration, the company’s breakeven point is $1.65 million, meaning they have to generate $1.65 million in sales in order to cover their fixed costs and not incur a net loss. If they switch to an outsourced logistics operation, the breakeven point drops to $1.5 million (if the fulfillment cost remained at $5.38 with the outsourced logistics, the breakeven point would still be lower at $1.56 million).

In Scenario 1, sales drop by 40%, the fixed costs cannot be decreased to offset the lower gross profit, so the net loss would be much greater where the company manages its own warehousing. This also makes intuitive sense since the company’s unused space would be even greater with the lower volume.

In Scenario 2, the company’s sales increase by 50% over the baseline. The company would post a higher net profit by managing its own facility, since the fulfillment costs would drop to $4.54 per package.

Other Things to Consider

As we can see, using outsourcing to make the cost structure more variable can provide many benefits, especially if sales volumes are uncertain. Conversely, if a company can reach a certain level, it can benefit from economies of scale. Generally speaking, it is more difficult to shed fixed costs once they are already in place. For hard assets (buildings and equipment), asset recovery rates may not be favorable, especially in distressed economic times. For rental facilities, there are costs to break a lease. If personnel are part of the fixed costs, then you need to consider severance expenses as part of the transition.

For early stage companies, the focus should generally be on keeping the cost structure variable as the uncertainty surrounding the timing of new sales can put a great strain on the company’s liquidity.

As far as the frequency to assess the breakeven point, annually is probably adequate for many businesses. If a business is an early stage start-up, quarterly might make more sense to help guide discussions on capital requirements and making the best investments in future growth.

Generally, investing in the future will raise your breakeven point, but this can be a strategic move that pays off in the long run. For instance, hiring high-priced personnel at a start-up will make a dramatic change in the breakeven level. However, if that talent can successfully complete a product to take to market, it can pay off in the form of additional revenue, as well as increasing the likelihood of raising additional capital.