Quoting new business is pretty straightforward, all you need to do is make sure the quoted price is greater than the costs and the new job should translate to a profit (in theory). The trick is making sure the costs being contemplated are indeed the right costs. If you are a distributor, most of your costs should be certain, since you know exactly the price that is paid for each item. On the flip side, for manufacturing, this can become more challenging as overhead is assigned to products (sometimes arbitrarily). The best description I ever heard from a client on how overhead is assigned, was that it was like peanut butter. Cue the quizzical look on my face, and the next response was “It’s just spread.”

I will cover zero-base budgeting in an upcoming article that will discuss how to better understand what overhead is used and where in an organization.

Lessons in Manufacturing:

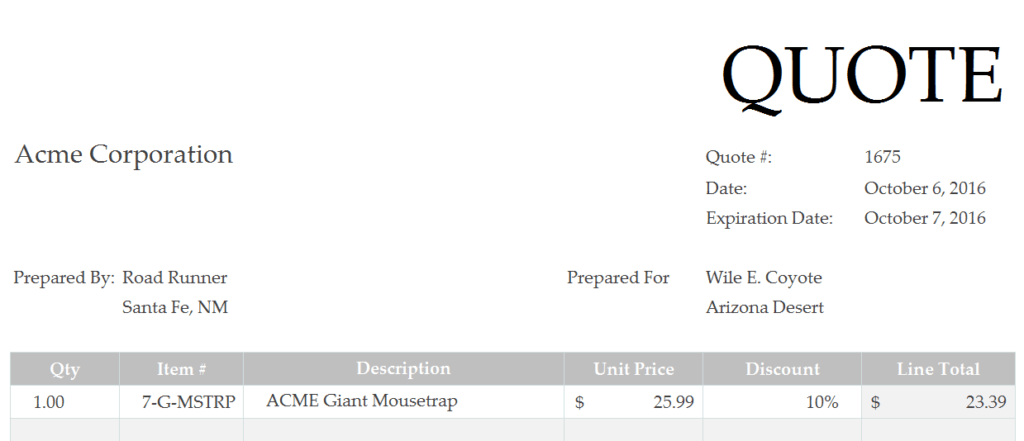

The following example shows some of the challenges a manufacturing firm can have when quoting new business. The example below references a firm that uses standard costs for their products, separate standards for material, labor (direct wages only) and overhead. This approach is fairly common and it plays nice with others (the company’s accounting system, the occasional IRS audit, etc.).

The company began noticing that its success rate in winning new business was declining and the feedback was that the company’s pricing was too high (admittedly, many companies will say this no matter what). We took a deeper dive into the company’s approach and found some things that needed modifying since the business had changed over time.

- Issue #1: Labor Rates – As we mentioned above, the standard cost for labor only included the direct wages, not the associated payroll taxes and benefits. These additional labor costs were built into the corporate overhead rate. This was fine when quoting jobs that mirrored the company average for labor and overhead utilization . If there was a deviation, the company was either under bidding jobs with higher labor (where the actual profit would be less) and rejecting jobs with higher levels of automation (which could be more profitable than quoted).

The Fix: New quote rates were established instead of using the standards from the accounting system. The new labor rate was based on a fully-burdened direct labor rate, assigning all payroll taxes and benefit costs for employees directly engaged in production. At the same time, payroll taxes and benefit costs were stripped out of the overhead rate. The labor rate increased by 58%, while the rate for manufacturing overhead decreased by 19% alone due to that one factor. - Issue #2: Specialized Tooling – In this particular company, certain products require a disproportionate amount of very specialized tooling (i.e. expensive) that is consumed in the production process, this was a shift in the business over the last 5-6 years. The cost for this tooling ranged from 12-15% of sales, whereas, the labor standard (wages only for direct labor) ranged from 9-12% of sales. The overhead rate for accounting purposes does not distinguish between these expenses for particular jobs.

The Fix: All costs for specialized tooling were removed from the overhead rate, dropping the rate another 19% (35% from starting point). On all new jobs, any specialized tooling is itemized separately. The challenge here is that for a brand new product, there needs to be a good understanding of the specialized tooling required. - Issue #3: Equipment – Depreciation expense for the building and equipment is factored into the overhead rate. However, when quoting for new jobs which require adding new equipment, the company was double counting the allocation of existing equipment (via the overhead rate), plus the cost of new equipment.

The Fix: Again, the specific portion of depreciation for existing equipment was removed from the overhead rate, this reduced the overhead rate another 15% (44% from starting point). The company can now distinguish quotes for jobs that can run on existing equipment, and other jobs that would require significant investments in new machinery.

The feedback from prospective customers was that under the new quoting methodology, the company’s bids were much more competitive. This also opened the door to re-kindle relationships with other prospective customers who had given up over time on obtaining quotes from this particular company..

Lessons from other companies:

- Drop Shipping – If you are a distributor and have the ability to drop ship product from suppliers, this should be contemplated for certain orders, as it lessens the costs associated with excess handling of goods. Of course, some companies may charge for this service, or offer it at a different price (another way of charging), this all needs to be factored in. One pitfall I have witnessed with this involved an international shipment (sent direct from the supplier). Since the proper process was not followed, the carrier (FedEx in this case) ended up paying (and of course billing the company) over $600 in taxes and duties on an order that was less than $100. Naturally, this was uncovered well after the fact.

A separate issue to keep in mind is whether or not this could open up the door for your supplier and customer to bypass you as the product source. - Specifications – Specifications are extremely crucial. By failing to read the fine print, critical costs can be overlooked, especially when dealing with new firms or new industries. For instance, certain government jobs can require very unique criteria. I had a client that built a division that was solely focused on finding suppliers for government contracts. Their competitive advantage was their personnel, they were superior at understanding specifications and were very efficient at negotiating with suppliers.

Also related to specifications is how the order needs to be shipped and invoiced, particularly when dealing with Big Box Retail. I have seen some horror stories, but that will be a separate post, it’s worthy of its own space (and then some).